Investor Newsletter - September 2025

To win in the stock market, you can’t afford to live as a permanent bull or a permanent bear. The market punishes single-mindedness. The real edge comes from embracing both identities at the same time.

That may sound contradictory—how can you be optimistic and pessimistic at once? The answer: you don’t choose sides, you engineer them.

And the most elegant engineering tool is the covered call.

Real illustration

Case Study: TSLL in Action

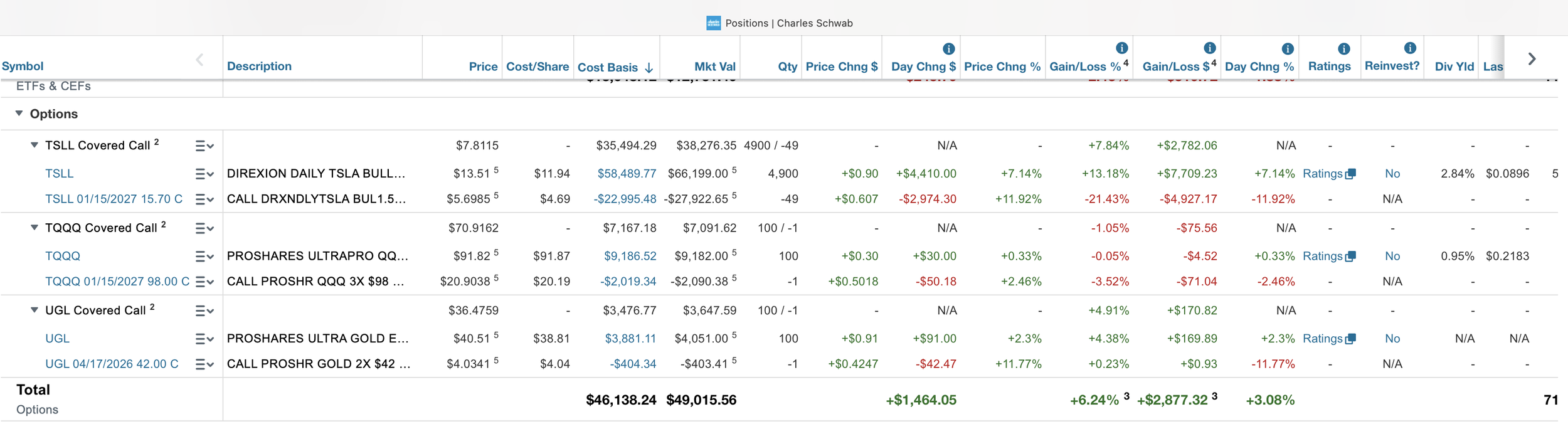

Let’s look at a live Alejos Capital Group example with TSLL, the Direxion Daily Tesla Bull 2x ETF.

Position: 4,904 shares at $11.94 cost basis

Current Price: $13.40 (+12.26%)

That’s the bull side. We’re participating in Tesla’s leveraged upside.

Now, the bear:

Overlay: 49 calls sold (Jan 2027, $15.70 strike)

Premium Collected: $23,000 upfront income

The shares climb. The calls limit the upside. The premium smooths the downside. Both forces coexist, and both forces pay.

Covered Calls

Why This Works

Dual Cash Flows: Gains from capital appreciation + option premium income.

Risk Balance: Willingness to cap upside provides certainty and predictability.

Volatility Harvesting: With TSLL’s implied volatility at 101.99%, the market pays generously for the privilege of risk transfer.

This is the paradox of the covered call:

You ride the bull. You sell the bear. You profit from both.

The Illusion of “Liability”

If you’re using a brokerage like Schwab, you’ve probably noticed this: the covered call appears as a negative position, almost like a debt or liability. This is misleading.

Here’s the truth:

You Already Own the Shares

The call you sold is backed by stock you hold. This isn’t naked risk.The Premium Is Yours

That “liability” exists alongside cash you’ve already collected. In our TSLL case, $23,000 hit the account immediately.Obligation ≠ Debt

Schwab marks the call as “short,” but you don’t owe money. You simply agree to sell shares at the strike if exercised. That’s an obligation, not a loan.Time Decay Works in Your Favor

What looks like a liability is really a melting ice cube — every day, theta erodes the option’s value, moving profit your way.

Translation: Schwab calls it a liability. We call it prepaid income.

Investor’s Note

The lesson here isn’t about TSLL alone. It’s about philosophy.

When you create spreads, you are no longer a victim of direction—you are an architect of probability. You’ve engineered your seat at the table no matter how the dice roll.

At Alejos Capital Group, we don’t believe in picking bull or bear. We believe in becoming both.

That is how you win.